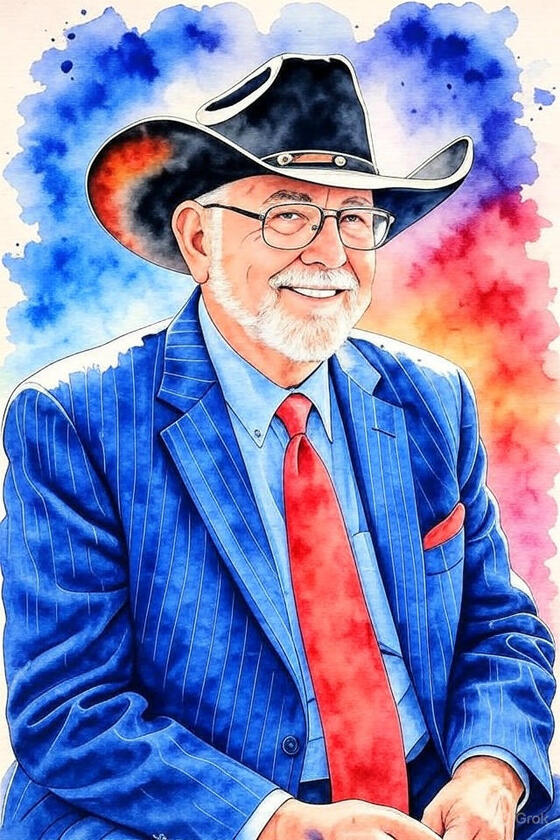

Barry Zalma: Insurance Claims Expert Witness

Posted on September 3, 2025 by Barry Zalma

The Need for a Claims Handling Expert to Defend or Prove a Tort of Bad Faith Suit

© 2025 Barry Zalma, Esq., CFE

When I finished my three year enlistment in the US Army as a Special Agent of US Army Intelligence in 1967, I sought employment where I could use the investigative skills I learned in the Army. After some searching I was hired as a claims trainee by the Fireman’s Fund American Insurance Company. For five years, while attending law school at night while working full time as an insurance adjuster I became familiar with every aspect of the commercial insurance industry.

On January 2, 1972 I was admitted to the California Bar. I practiced law, specializing in insurance claims, insurance coverage and defense of claims against people insured and defense of insurance companies sued for breach of contract and breach of the implied covenant of good faith and fair dealing. After 45 years as an active lawyer, I asked that my license to practice law be declared inactive and became a consultant and expert witness for lawyers representing insurers and lawyers representing policyholders where I had no conflict of interest. I have testified as an expert in multiple different courts from my home in Los Angeles County, California to the British Virgin Islands and many different states in both state and federal courts as an expert on claims handling and insurance coverage.

Since I became a full time consultant and expert witness and author of books relating to insurance coverage, insurance law, and insurance claims handling books, I testified often except that a majority of my assignments resulted in negotiated settlements after the presentation of an expert report in federal court or my deposition in state and federal court cases because either insurers acted fairly and in good faith that I could support with the evidence available or where it was obvious that the insurer’s staff failed to fulfill the minimum standards set by the custom and practice of the industry or the Regulations enacted in various states to require good faith claims handling by insurers.

I have served as an insurance claims handling testifying expert witness for more than ten years. In that capacity I analyze all evidence collected by the parties to a dispute over claims handling and prepare an expert’s report that involves explaining the customs and practices of the insurance industry, ensuring fair and good faith claims handling, and supporting evidence in legal cases. The insurance claims handling expert’s expertise is essential in defending or proving claims in court about breach of the insurance contract or the claim of unfair and bad faith claims handling.

FIRST PARTY PROPERTY INSURANCE CLAIMS INVESTIGATION CUSTOMS AND PRACTICE

The customs and practice of the insurance industry requires both the insurer and the insured to do nothing to prevent the other from receiving the benefits of the contract. An insurer’s thorough investigation includes, always, providing claims services where the insured can count on the insurer to be there for the insured and treat the insured fairly and in good faith.

Only with a staff of claims handlers dedicated to excellence in claims handling can insurers promptly, fairly and in good faith keep the promises made by the insurance policy and avoid charges of breach of contract and the tort of bad faith in first party property claims like those submitted to an insurer by its Insureds.

For the claims staff of an insurer to provide excellent and good faith claims handling, they must follow the minimum standards set by the Fair Claims Standards and Regulations adopted by the state of California, the state of New York and other states controlling the standards of claims handling imposed on insurers.

Insurers must understand that they cannot adequately fulfill the promises they make to their insureds and their obligations under fair claims practices acts, the Fair Claims Standards, without a professional, well trained and experienced claims staff.

The practice of doing nothing that would prevent the other from receiving the benefits of the contract continues from the inception of the policy until all claims are resolved even if litigation commences.

Professional insurers understand that when the claims staff is made up of claims people who treat all insureds and claimants with good faith and fair dealing and who provide excellence in claims handling, litigation between the insurer and its insureds will be reduced exponentially and that the obverse is also true.

The customs and practice of the insurance industry require that the insurer thoroughly investigate each claim presented under the policy, determine which provision of the policy applies to the loss the insured has incurred and work to adjust each claim under every potential insuring agreement in the policy promptly and fairly.

When an insured reports a loss claiming that the basic elements of its business have been damaged or destroyed by a major fire like those brought about by a wildfire. The customs and practice of the first party property insurance claims industry is to assign a field adjuster (either an employee of the insurer or a licensed independent insurance adjuster) who can meet at the loss location with the insured and assist the insured in the creation of a complete scope of loss and begin the work necessary to determine valuation of all the damaged or destroyed property and begin the effort of the insured to prove the loss and reach an agreement with the insurer.

The claims adjuster or licensed independent adjuster must, in the customs and practice of the insurance first party property claims industry first read and understand every word in the policy and then determine every provision or insuring agreement that might provide coverage to the Insureds.

The Use of an Expert Witness in Litigation

As an expert for the policyholder or the insurer, I report that the customs and practice of the insurance industry and why insurers must conduct a thorough insurance claims investigation before making a decision with regard to the compensability of a claim presented by Insureds. I would testify that in my expert and professional opinion the customs and practice of the insurer did not conduct a thorough investigation of the claims presented by the Insureds or it did. I would opine that the insurer completed a thorough claims investigation or, depending on the facts, did not conduct the fair and complete thorough investigation of the claim presented to the insurer.

Every lawsuit alleging breach of an insurance contract, breach of the implied warranty of good faith and fair dealing needs an expert to explain to the judge or jury the custom and practice of the insurance industry who can explain the reasons for the custom and practice and how the insurer fulfilled the custom and practice or failed to fulfill the custom and practice fairly and in good faith. Without an expert to explain the needed conduct to the trier of fact (judge or jury) the position of the party without an effective expert will usually be defeated and the party with an effective expert, coupled with admissible evidence, will convince the jury, judge or both that the position taken by the party was appropriate or the other party’s actions were inappropriate.

How The Expert Reaches His or Her Opinions

To act as a knowledgeable, fair and effective expert the person acting as an expert must read and analyze:

The insurer’s claims files.

The insurer’s underwriting files.

The operatives pleadings in the litigation including:

The Complaint or Petition.

The Answer or dispositive motions.

Discovery responses.

Interrogatories and responses.

Requests for Admission and responses.

Requests for production of documents.

All documents produced.

Depositions of adjusters, supervisors and claims executives.

Depositions of insureds.

Depositions of independent witnesses.

Depositions of contractors and reconstruction experts.

Deposition of adverse experts.

Review and Analyze the state in which the loss occurred Fair Claims Settlement Practices statute and Regulations created to enforce the statute.

Prepare a formal report of opinions and conclusions.

Work with counsel to prepare for the expert’s deposition.

Be prepared to testify at deposition and trial.

The preparation to testify as an expert can take a great deal of time depending on the extent of the loss and the documentary evidence needed to form a fair and reasonable opinion.

How to Testify as an Expert

An expert witness is not a fact witness. He or she is only an opinion witness whose testimony is based upon many year of experience, training and education in the field about which he or she testifies. The expert’s testimony is limited to his or her opinions and may not testify to opinions as to the ultimate facts of the case about which the party who retained the expert seeks. The expert’s role is simply to inform the judge or jury about industry customs and practices. Even if the expert believes, from his or her review, that a party has breached the contract of insurance, acted tortiously, or acted in breach of the covenant of good faith and fair dealing, the expert will leave the conclusions to the jury or the judge or both.

If the expert does his or her work properly the judge or jury will have enough information to make a decision on the cases that are the subject of the litigation.

When I testify as an expert I will either explain how the insurer met or exceeded the minimum standards set by the Fair Claims Settlement Practices Regulations and either fulfilled or failed to fulfill the custom and practice of the insurance industry.

I have been asked many times to testify for an insurer or a policyholder where the facts I reviewed and my experience and training reveal that my testimony would be contrary to the needs and desires of the lawyer who retained me. It is unethical and improper for an expert to testify as directed by the attorney who retained the expert. In cases where I conclude my testimony will benefit the case of the party who did not retain me I require counsel who retained me to fire me as his or her expert and I return the retainer and close my file.

I have been involved with the business of insurance since I was released from the US Army in 1967 where I acted as an insurance adjuster handling first and third party claims while I attended law school at night. As a lawyer I served as a defense lawyer and as an insurance coverage lawyer for about 45 years when I dissolved my law firm, asked the California Bar to make my license to practice law inactive and changed my practice to only act as a consultant and expert witness.

Mr. Zalma’s rates are all inclusive. Mr. Zalma’s hourly fee of $600 per hour includes all incidentals from telephone calls and postage to computer time and word processing. As for third-party costs, Zalma passes along all discounts and vendor savings.

The client pays what Barry Zalma, Inc. pays. Not a penny more. Barry Zalma, Inc. has made the billing process simple.

Contact Mr. Zalma at 310-390-4455 or by e-mail at [email protected]

(c) 2025 Barry Zalma & ClaimSchool, Inc.

Please tell your friends and colleagues about this blog and the videos and let them subscribe to the blog and the videos.

Subscribe to my substack at https://barryzalma.substack.com/subscribe

Go to X @bzalma; Go to Barry Zalma videos at Rumble.com at https://rumble.com/account/content?type=all; Go to Barry Zalma on YouTube- https://www.youtube.com/channel/UCysiZklEtxZsSF9DfC0Expg; Go to the Insurance Claims Library – https://lnkd.in/gwEYk.

Convicted Criminal Seeks to Compel Receiver to Protect his Assets

Post number 5291

See the video at and at and at https://www.zalma.com/blog plus more than 5250 posts.

The Work of a Court Appointed Receiver is Constitutionally Protected

In Simon Semaan et al. v. Robert P. Mosier et al., G064385, California Court of Appeals, Fourth District, Third Division (February 6, 2026) the Court of Appeals applied the California anti-SLAPP statute which protects defendants from meritless lawsuits arising from constitutionally protected activities, including those performed in official capacities. The court also considered the doctrine of quasi-judicial immunity, which shields court-appointed receivers from liability for discretionary acts performed within their official duties.

Facts

In September 2021, the State of California filed felony charges against Simon Semaan, alleging violations of Insurance Code section 11760(a) for making...

When There are Two Different Other Insurance Clauses They Eliminate Each Other and Both Insurers Owe Indemnity Equally

Post number 5289

In Great West Casualty Co. v. Nationwide Agribusiness Insurance Co., and Conserv FS, Inc., and Timothy A. Brennan, as Administrator of the Estate of Pat- rick J. Brennan, deceased, Nos. 24-1258, 24-1259, United States Court of Appeals, Seventh Circuit (February 11, 2026) the USCA was required to resolve a dispute that arose when a tractor-trailer operated by Robert D. Fisher (agent of Deerpass Farms Trucking, LLC-II) was involved in a side-impact collision with an SUV driven by Patrick J. Brennan, resulting in Brennan’s death.

Facts

Deerpass Trucking, an interstate motor carrier, leased the tractor from Deerpass Farms Services, LLC, and hauled cargo for Conserv FS, Inc. under a trailer interchange agreement. The tractor was insured by Great West Casualty Company with a $1 million policy limit, while the trailer was insured by Nationwide Agribusiness Insurance Company with a $2 million ...

Opiod Producer Seeks Indemnity from CGL Insurers

Post number 5288

Read the full article at https://lnkd.in/guNhStN2, see the full video at https://lnkd.in/gYqkk-n3 and at https://lnkd.in/g8U3ehuc, and at https://zalma.com/blog plus more than 5250 posts.

Insurers Exclude Damages Due to Insured’s Products

In Matthew Dundon, As The Trustee Of The Endo General Unsecured Creditors’ Trust v. ACE Property And Casualty Insurance Company, et al., Civil Action No. 24-4221, United States District Court, E.D. Pennsylvania (February 10, 2026) Matthew Dundon, trustee of the Endo General Unsecured Creditors’ Trust, sued multiple commercial general liability (CGL) insurers for coverage of opioid-related litigation involving Endo International PLC a pharmaceutical manufacturer.

KEY FACTS

Beginning as early as 2014, thousands of opioid suits were filed by governments, third parties, and individuals alleging harms tied to opioid manufacturing and marketing.

Bankruptcy & Settlements

Endo filed Chapter 11 in August 2022; before bankruptcy it ...

Passover for Americans

Posted on February 19, 2026 by Barry Zalma

“The Passover Seder For Americans”

For more than 3,000 years Jewish fathers have told the story of the Exodus of the enslaved Jews from Egypt. Telling the story has been required of all Jewish fathers. Americans, who have lived in North America for more than 300 years have become Americans and many have lost the ability to read, write and understand the Hebrew language in which the story of Passover was first told in the Torah. Passover is one of the many holidays Jewish People celebrate to help them remember the importance of G_d in their lives. We see the animals, the oceans, the rivers, the mountains, the rain, sun, the planets, the stars, and the people and wonder how did all these wonderful things come into being. Jews believe the force we call G_d created the entire universe and everything in it. Jews feel G_d is all seeing and knowing and although we can’t see Him, He is everywhere and in everyone.We understand...

Passover for Americans

Posted on February 19, 2026 by Barry Zalma

Read the full article at https://www.linkedin.com/pulse/passover-americans-barry-zalma-esq-cfe-5vgkc.

“The Passover Seder For Americans”

For more than 3,000 years Jewish fathers have told the story of the Exodus of the enslaved Jews from Egypt. Telling the story has been required of all Jewish fathers. Americans, who have lived in North America for more than 300 years have become Americans and many have lostthe ability to read, write and understand the Hebrew language in which the story of Passover was first told in the Torah.

Passover is one of the many holidays Jewish People celebrate to help them remember the importance of G_d in their lives. We see the animals, the oceans, the rivers, the mountains, the rain, sun, the planets, the stars, and the people and ...

You Get What You Pay For – Less Coverage Means Lower Premium

Post number 5275

Posted on January 30, 2026 by Barry Zalma

See the video at and at

When Experts for Both Sides Agree That Two Causes Concur to Cause a Wall to Collapse Exclusion Applies

In Lido Hospitality, Inc. v. AIX Specialty Insurance Company, No. 1-24-1465, 2026 IL App (1st) 241465-U, Court of Appeals of Illinois (January 27, 2026) resolved the effect of an anti-concurrent cause exclusion to a loss with more than one cause.

Facts and Background

Lido Hospitality, Inc. operates the Lido Motel in Franklin Park, Illinois. In November 2020, a windstorm caused one of the motel’s brick veneer walls to collapse. At the time, Lido was insured under a policy issued by AIX Specialty Insurance Company which provided coverage for windstorm damage. However, the policy contained an exclusion for any loss or damage directly or indirectly resulting from ...